In today’s consumer-driven society, debt has become a common aspect of financial life for many individuals and households. While borrowing money can help achieve important goals, such as buying a home or pursuing higher education, it can also lead to financial stress if not managed wisely. Debt management is a crucial skill that empowers individuals to take control of their financial well-being and work towards a debt-free future. In this article, we explore the significance of debt management, its key principles, and practical strategies for regaining financial freedom and empowerment.

Understanding Debt Management

Debt management is the strategic and proactive management of debts to ensure they remain manageable, affordable, and aligned with one’s financial goals. It involves creating a plan to pay off debts systematically while avoiding excessive borrowing or accumulating unnecessary interest and fees. Debt management is not about avoiding debts altogether but rather about using credit responsibly and ensuring that debt does not become a burden on one’s financial health.

Key Principles of Debt Management

- Budgeting: The foundation of debt management lies in creating and following a budget. A budget helps individuals track income, expenses, and debt repayments, ensuring that money is allocated wisely to meet financial obligations.

- Prioritizing Debt Repayment: Debt should be prioritized based on interest rates, with high-interest debts tackled first. This approach minimizes the overall interest paid and accelerates the journey to debt freedom.

- Avoiding New Debt: While managing existing debt, it is essential to avoid taking on new debt unless necessary. Unnecessary borrowing can lead to a cycle of debt that becomes challenging to escape.

- Building an Emergency Fund: Creating an emergency fund provides a safety net to handle unexpected expenses without relying on credit cards or loans.

Practical Strategies for Debt Management

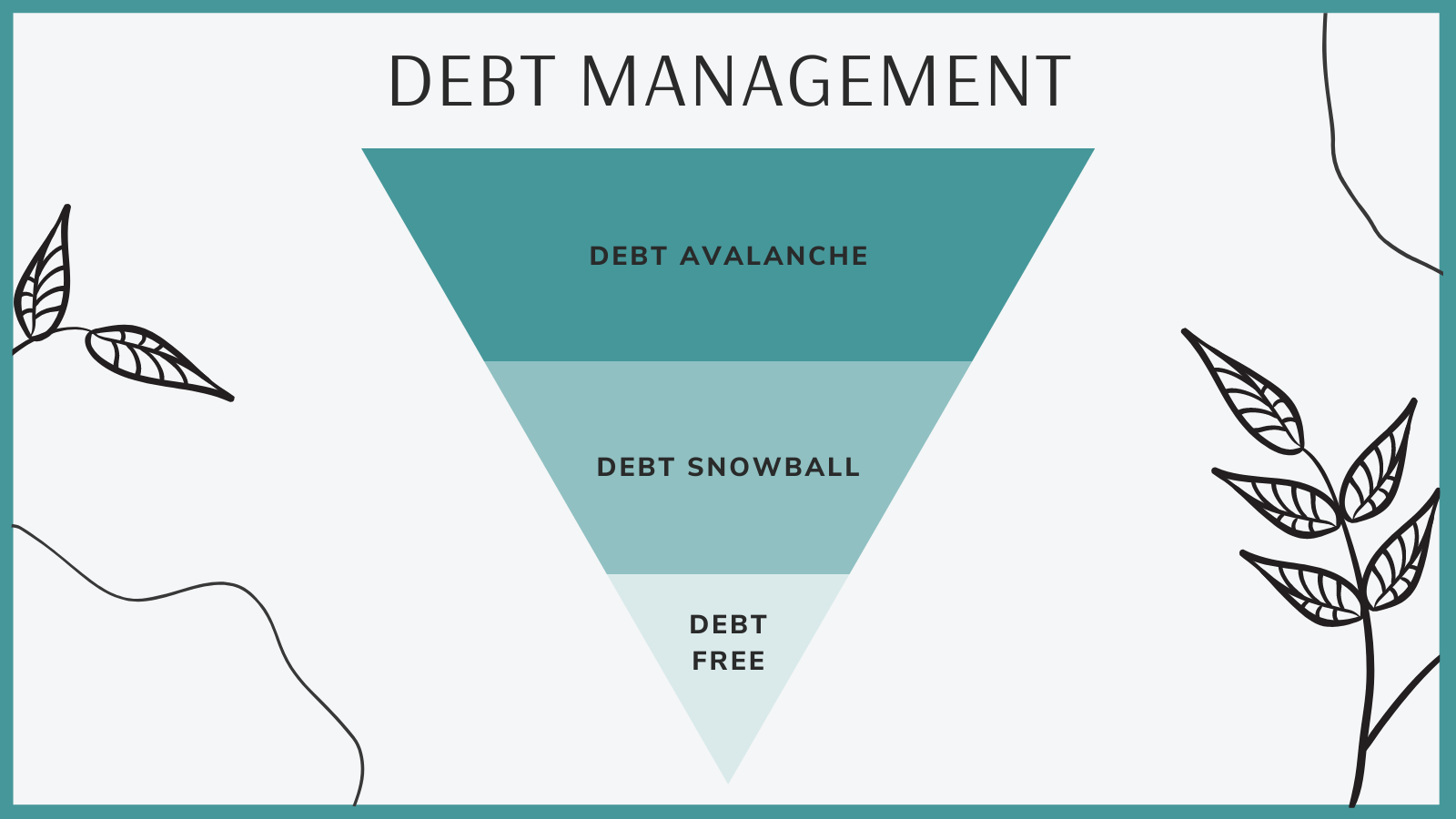

- Snowball Method: This strategy involves paying off the smallest debts first while making minimum payments on larger debts. As small debts are eliminated, the freed-up funds can be applied to larger debts, creating momentum like a snowball rolling downhill.

- Avalanche Method: In this approach, the focus is on paying off debts with the highest interest rates first, reducing the overall interest paid over time.

- Debt Consolidation: For individuals with multiple high-interest debts, consolidating them into a single lower-interest loan or balance transfer credit card can make repayment more manageable.

- Negotiating with Creditors: In challenging financial situations, it is possible to negotiate with creditors for lower interest rates or more favorable repayment terms.

Benefits of Effective Debt Management

- Financial Freedom: By implementing debt management strategies, individuals can regain control over their finances and work towards a debt-free future.

- Reduced Stress: Managing debts responsibly can alleviate financial stress and anxiety, leading to improved overall well-being.

- Improved Credit Score: Responsible debt management can positively impact credit scores, opening up better borrowing options in the future.

- Enhanced Savings and Investments: As debts are paid off, individuals have the opportunity to redirect funds towards savings and investments, building wealth for the future.

Conclusion

Debt management is an essential aspect of financial well-being, empowering individuals to take charge of their financial future. By adopting key principles such as budgeting, prioritizing debt repayment, and avoiding unnecessary borrowing, individuals can regain financial freedom and work towards a debt-free life. Practical strategies like the snowball and avalanche methods, debt consolidation, and negotiation with creditors can further facilitate the journey to debt freedom. Through effective debt management, individuals can break free from the burden of debts, achieve financial empowerment, and pave the way for a secure and prosperous financial future.